Announcement of a new reform of the legislation governing the taxation of Capital gains derived from the sale of securities

During his closing speech at the Assises de L’entrepreneuriat (i.e. meetings and talks which discussed entrepreneurship in France) on April 29, 2013, French President François Hollande announced a series of measures in favor of businesses. Such measures have a three-fold objective: stimulate entrepreneurship and mobilize all talents, foster the growth and development of businesses and recognize the value of investment risk-taking in support of employment.

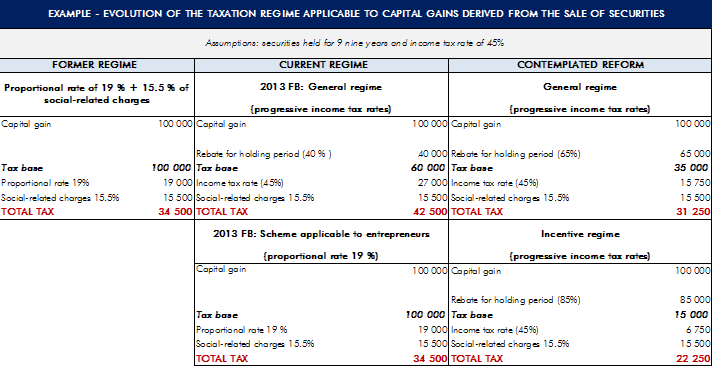

A tax measure has particularly drawn our attention. Indeed, the Government proposes a new reform of the legislation governing the taxation of capital gains derived from the sale of securities, thereby marking a partial shift from the rules introduced by the 2013 Finance Bill (“2013 FB”).

1. Reform of the rules governing the taxation of capital gains derived from the sale of securities

The Government proposes to backtrack on the reform of the taxation of capital gains derived from the sale of securities introduced by the 2013 FB, even though such reform has not even started being implemented.

The contemplated new rules have a dual aim: simplifying the taxation of capital gains derived from the sale of securities and encouraging risk-taking and long-term investment.

As such, two basic taxation regimes would be created: an “ordinary regime” and an “incentive regime” that would replace the currently applicable exemption schemes. Under both regimes, all capital gains derived from the sale of securities would be subject to the progressive income tax rates, whatever the capacity of the taxpayer (private individual, entrepreneur, etc.).

Consequently, the flat tax rate of 19% applicable to the capital gains earned by entrepreneurs, as provided for in the 2013 FL, would be abandoned.

1.1. General Regime

The Government proposes that, under the general regime, the capital gains derived from the sale of securities would be subject to the progressive income tax rates, with application, after a two-year holding period, of a rebate up to:

- 50% of the capital gains between two and less than eight years of holding,

- 65% of the capital gains after eight years of holding.

As such, there would be no rebate on the potentially earned capital gains if the underlying securities are sold less than two years from their acquisition.

1.2. Incentive Regime

The incentive regime aims at fostering the creation of businesses and encouraging risk-taking by bringing together the various exemption regimes available to retiring managers of SMBs, young innovative companies and transfers between family members. It would also apply to the sale of shares in SMBs incorporated for less than 10 years.

The rebate rates would be increased up to:

- 50 % of the capital gains between one and less than four years of holding;

- 65 % of the capital gains between four and less than eight years of holding;

- 85 % after eight years of holding.

Furthermore, an additional rebate of 500,000 Euros would apply on the amount of taxable capital gains realized by retiring managers of small companies.

1.1. Entry into force

The conditions for the entry into force of this reform – that would be included in the Draft Finance Bill for 2014 – have not yet been specified. It seems, however, that the new rules would apply to capital gains earned as from January 1, 2013. Yet, the current rules could be maintained throughout 2013 if they are more favorable of the tax payer, such as the exemption available to retiring managers of SMB that was supposed to remain in effect until 2017.

Strategic Lawyering

Strategic Lawyering