How does the wage tax work under french law?

The wage tax is a tax due by France-based companies that are not subject to VAT for the entirety of their turnover. This tax is calculated on the basis of the remunerations paid to employees and is currently addressed in Parliamentary discussions on both the Amended Finance Bill for 2012 and the Social Security Finance Bill for 2013.

This is, therefore, a perfect time to provide a brief overview of this tax that was conceived as the counterpart of VAT for sectors and business that are precisely VAT exempt.

1. Who is liable for the wage tax?

This tax is due by employers who are not liable to VAT or not liable to VAT on at least 90% of their previous year turnover. As such, it never applies to industrial or commercial companies that invoice VAT for their services or products.

In practice, tax payers are mainly banks, insurance companies, financial institutions and organizations conducting a civil or mixed-activity like holding companies that receive dividends on their shareholding interests. As such, it can affect a large number of groups held by a holding company with a two-fold role: provide services to the companies of the group they head and capitalize on the group income through the payment of dividends from subsidiaries.

2. How will the wage tax be calculated?

2.1 Modification of the sums liable to the wage tax

Since the year 2000, the wage tax calculation method was mainly the same as that used to calculate social security contributions, i.e. the total amount of gross wages paid to each employee.

On the other hand, all sums that were not considered as a wage/salary pursuant to social security law (e.g. payments made under a mandatory and optional profit-sharing plan, savings plan, etc.) were not taken into account in the calculation of the wage tax.

Henceforth, the wage tax base shall be aligned with that of the Contribution Sociale Généralisée (Social Security Tax or “CSG”) which is much wider. Specifically, above certain thresholds to be defined, sums received under mandatory and optional profit-sharing plans, contributions made to an employee savings plans and termination indemnities shall be taken into account in the calculation of the wage tax.

These new measures shall apply for remunerations paid as from January 1, 2013.

2.2 Prorated taxation

If the company is already partly liable to VAT, it will only be partly liable to the wage tax, in proportion to the amounts not subject to VAT.

If the company operates in several distinct sectors of activity, it will be necessary to calculate the prorated amounts independently for each sector and to apply such amounts to the remunerations paid to the employees assigned to each sector.

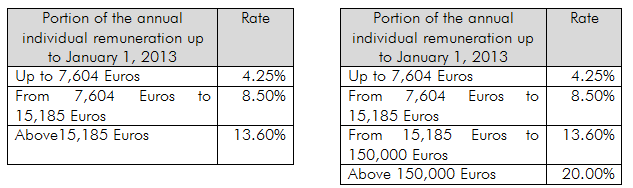

2.3 Change in the wage tax scale

For all remunerations included in the wage tax base paid as from January 1, 2013, an additional tax bracket has been created for individual remunerations above 150,000 Euros.

Yet, in the framework of the so-called competitiveness pact, deductions available for small structures should be enhanced by January 1, 2014 at the latest.

3. The specific case of holding companies and their officers

The contemplated increase in the applicable wage tax scale is likely to penalize especially active holding companies that often employ the best paid employees.

As indicated, any holding company may be subject to the wage tax if (i) it has employees or officers assimilated to employees for French social security purposes, and (ii) it receives financial income (dividends, interests, etc.).

Yet, for mixed holding companies that are liable to the wage tax only because they receive dividends, the payment of the tax can be reduced, even avoided, depending on the decisions that have been made by their subsidiaries with respect to dividend distribution.

Further, even though the Council of State has recalled, in four decisions dated June 8, 2011, that any management function is in fact a cross-disciplinary function by nature and that, consequently, the remuneration paid to corporate officers were, at least partially, subject to wage tax, it is still possible to produce evidence to the contrary.

Indeed, this presumption can be rebutted if the company can demonstrate that one or several of its officers was/were not legally empowered to act in the financial sector not subject to VAT.

Other avenues can be explored, depending on the particular situation of a group:

- a holding company may be exempt from the wage tax if it receives dividends only every other year;

- when the holding company is incorporated in the form of a société à responsabilité limitée, the non-salaried status of majority-owner manager should be implemented;

- It is possible to perform an operational reorganization to isolate all financial functions in a pure holding company.

Strategic Lawyering

Strategic Lawyering