New rules on taxation of foreign trusts in France

While the trust, an Anglo-American wealth management tool, has been increasingly used in France in the past few years, it still remains little known and moderately appreciated.

This situation is all the more surprising as the trust structure was historically born in France at the time of the Crusades during the 12th and 13th centuries. Back then, knights would entrust the management of their estate and properties to a man of confidence and would grant him extended powers to run the entrusted estate and properties. The proceeds derived therefrom were then supposed to benefit the wife and the children of the crusader.

Nowadays, even though trusts have lost some of their original functions, they are widely used in other countries, in particular common law countries.

French tax rules applicable to foreign trusts have remained unclear for quite a long time. This situation has, however, been remedied since the 2011 Amended Finance Law adopted on July 29, 2011 in the framework of the reform of the property taxation regime.

Article 14 of the 2011 Amended Finance Law introduced brand new tax rules with respect to inheritance tax and gift tax (Article 792-0 bis of the French Tax Code, hereinafter “FTC”) and wealth tax (Article 885 G ter of the FTC) in order to remove the “legal uncertainty” resulting from the “peculiarity of the concepts” and, in fact primarily, to avoid that trusts be used for tax evasion purposes or even tax optimization purposes.

More specifically, French tax law now:

- Provides its own definition of trust;

- Establishes the conditions in which the assets held in a trust will be taxed (inheritance/gift tax, income tax, wealth tax);

- Provides that the income derived from the assets held in a trust will be exempt from taxation until distributed to a beneficiary;

- Imposes reporting/disclosure requirements with respect to trusts.

As such, the management rules applicable to non-charitable and non-retirement trusts have been overhauled.

Definition of Trust:

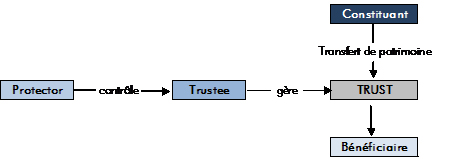

a) Trust structure

The structure of a trust can be outlined as follows:

The trust is a legal vehicle that enables a person referred to as the “constituant” (settlor) to vest assets to another person referred to as the “administrateur” (trustee) who will be responsible to manage such assets for the benefit of a third person referred to as the “bénéficiaire” (beneficiary), before delivering the assets to a fourth person referred to as the “attributaire en capital” (income beneficiary). Yet, these various capacities can be “mixed” and there can be several trustees or beneficiaries.

The trust can be analyzed as a superposition of two concepts: legal ownership and beneficial ownership. This distinction explains why French law has been so reluctant to recognize and legally qualify trusts, principally because of the two following fundamental French legal principles: unity of property law (excluding any overlap of rights over a single and same thing) and unicity of patrimony.

b) Definition of a trust under French law

The definition of trusts set forth in Article 792-0 bis of the FTC is mainly inspired by that provided for in the 1985 Hague Convention – signed but not ratified by France.

- Trust means the body of legal relationships created inter vivos or upon death, under the laws of a country other than France, whereby a settlor places assets or rights under the control of a trustee in the interests of one or more beneficiaries or for the accomplishment of a defined objective.

- Article 792-0 bis of the FTC also defines the concept of settlor. “Settlor” is defined as the natural person who sets up a trust or, in case the trust was set up by a natural person acting in a professional capacity or by a legal entity, the person who has placed the assets or rights in the trust.

Taxation of assets held in a trust

The 2011 Amended Finance Law has introduced brand new rules for the taxation of transfers made through a trust. These new provisions apply to gifts performed and deaths that occurred since July 31, 2011.

The 2011 Amended Finance Law has also introduced new rules with respect to wealth tax.

a) Gift and inheritance tax

- Transfer considered as a gift or inheritance under French law

As per Article 792-0 bis of the FTC, the transfer – via gift or inheritance – of assets or rights held in a trust and income capitalized therein shall be subject to standard inheritance or gift tax at a rate that will depend on the family relationship between the settlor and the beneficiary. The standard inheritance or gift tax shall be assessed on the net market value of the transferred assets, rights or income.

As such, when the transfers can be considered as a gift or inheritance under French law, it shall be subject to the standard gift or inheritance tax. This principle applies to both assets, rights and capitalized income held in the trust.

- Transfer not considered as a gift or inheritance under French law

When the transfer is not considered as a gift or inheritance, i.e. when standard inheritance or gift tax does not apply, a specific inheritance tax shall be levied upon the death of the settlor.

Such specific inheritance tax is due on the date of the settlor’s death, irrespective of whether the assets are transferred to the beneficiary(ies) on that date or subsequently.

Taxation will depend on the part of the assets that passes to the living or future trust beneficiaries. Three scenarios can apply:

- If, upon the settlor’s death, an identified part of the trust assets passes to a designated beneficiary, the inheritance tax is levied according to the family link between the beneficiary and the deceased settlor (Article 792-0 bis, II-2-a of the FTC).

- If, upon the settlor’s death, an identified part of the trust assets are “globally” due to descendants of the settlor, without it being possible to allocate the assets between such descendants, the inheritance tax will be calculated at the highest rate of the tax scale applicable to direct line beneficiaries, i.e. 45% (Article 792-0 bis, II-2-b of the FTC).

- In all other cases, the value of the assets, rights or capitalized income held in the trust shall be taxed at the highest rate of the tax scale applicable to collateral or unrelated beneficiaries, i.e. 60 % (Article 792-0 bis, II-2-c of the FTC).

On the other hand and as an exception to the foregoing, Article 792-0 bis, II of the FTC stipulates gift and inheritance tax shall anyway be levied at the highest rate of the tax scale applicable to collateral or unrelated beneficiaries, i.e. 60 %, if:

- the trustee is subject to the laws of a non-cooperating country or territory, as defined in Article 238-0 A of the FTC,

- the trust has been created after May 11, 2011 by a settlor who was a French tax resident at the time the trust was created.

This scenario is justified by the will to ensure consistency with the rules applicable to French fiducies according to which the transfer of assets held in a fiducie via gift or inheritance are subject to a 60% tax rate. This 60% tax rate applies, irrespective of the family relationship between the settlor and the beneficiary (identified part or “global” part of the trust assets).

Situation | Taxation | |

Gift or Inheritance | inheritance/gift tax calculated according to the family relationship | |

neither gift nor inheritance |

| inheritance/gift tax calculated according to the family relationship |

| 45 % | |

| 60 % | |

Exception |

| 60 % |

| 60 % | |

Since January 1, 2012, assets held in a trust (irrespective of whether the trust is revocable or not, discretionary or not) shall be taken into account in the settlor’s assets for wealth tax purposes if the global value of such combined assets exceeds 1,300,000 Euros (the market value to be retained is that as of January 1 of the taxation year).

Pursuant to the territorial rules governing wealth tax and subject to the provisions of applicable tax treaties, shall be subject to wealth tax:

- the assets held in a trust whose settlor is a French tax resident, irrespective of whether they are situated in France or in another country,

- the assets (except financial investments) situated in France and held in a trust whose settlor is not a French tax-resident.

However, as an exception, the FTC provides that assets held in a charitable trust shall not be taken into account in the calculation of settlor’s wealth tax.

In the event the above wealth tax filing obligations are not complied with, a special 0.50% tax shall apply.

Trust income reinvested in the trust are exempt from income tax

The 2011 Amended Finance Law restricts the scope of the income tax to the income derived from the “products” of the trust, as per Article 120, 9 of the FTC. Indeed, only “the income distributed by a trust, as defined in Article 792-0 bis of the FTC, whatever the composition, of the assets or rights placed in the trust” shall be subject to income tax. As such, income not distributed but reinvested in the trust are exempt from income tax.

However, as an exception to the foregoing, the income reinvested in the trust may be subject to taxation under Article 123 bis of the FTC that provides for taxation of the income derived from ownership interests held in foreign financial entities subject to a preferential tax regime.

The 2011 Amended Finance Law has introduced two new reporting/disclosure obligations for trustees, which are independent of each other:

- A one-off disclosure of information on the establishment, amendment or termination of the trust as well as on the terms and conditions thereof;

- An annual disclosure of the market value of the assets, rights or capitalized income held in the trust as at January 1st of each year.

These reporting/disclosure obligations apply if the settlor or at least one of the beneficiaries is a French tax resident or if any trust asset or right is situated in France.

Failing to comply with these disclosure/reporting requirements is sanctioned by a fine of 10,000 Euros or 5% of the value of the assets, right or capitalized income held in the trust, whichever is the higher.

This requirement came into force on January 1, 2012.

Strategic Lawyering

Strategic Lawyering